legenda46.site

News

Naira To The Dollar

A simple currency converter from United States Dollar to Nigerian Naira and from Nigerian Naira to United States Dollar. Easily convert USDC to Nigerian Naira USDC is a stablecoin redeemable on a basis for US dollars, backed by dollar denominated assets held in segregated. 1 NGN = USD Aug 31, UTC. Send Money. Check the currency rates against all the world currencies here. The currency converter below is easy to. Updated spot exchange rate of NIGERIA NAIRA (NGN) against the US dollar index. Find currency & selling price and other forex information. Stay current on all the latest USD NGN analysis and opinion pieces on our US Dollar Nigerian Naira Reports section. 1 Million Naira to Dollars 1,, Nigerian Nairas are worth $ today as of PM UTC. Check the latest currency exchange rates for the Nigerian. Download Our Currency Converter App ; 1 NGN, USD ; 5 NGN, USD ; 10 NGN, USD ; 20 NGN, USD. Our real time US Dollar Nigerian Naira converter will enable you to convert your amount from USD to NGN. All prices are in real time. Dollar to Naira exchange rate in Nigeria black market has an average of ₦1, today on 29/08/, according to 1 buy rate shared by the users as comments. A simple currency converter from United States Dollar to Nigerian Naira and from Nigerian Naira to United States Dollar. Easily convert USDC to Nigerian Naira USDC is a stablecoin redeemable on a basis for US dollars, backed by dollar denominated assets held in segregated. 1 NGN = USD Aug 31, UTC. Send Money. Check the currency rates against all the world currencies here. The currency converter below is easy to. Updated spot exchange rate of NIGERIA NAIRA (NGN) against the US dollar index. Find currency & selling price and other forex information. Stay current on all the latest USD NGN analysis and opinion pieces on our US Dollar Nigerian Naira Reports section. 1 Million Naira to Dollars 1,, Nigerian Nairas are worth $ today as of PM UTC. Check the latest currency exchange rates for the Nigerian. Download Our Currency Converter App ; 1 NGN, USD ; 5 NGN, USD ; 10 NGN, USD ; 20 NGN, USD. Our real time US Dollar Nigerian Naira converter will enable you to convert your amount from USD to NGN. All prices are in real time. Dollar to Naira exchange rate in Nigeria black market has an average of ₦1, today on 29/08/, according to 1 buy rate shared by the users as comments.

1 NGN = USD. Our Nigerian Naira to Dollar conversion tool gives you a way to compare the latest and historic interbank exchange rates for NGN to USD. Track and analyze Nigerian Naira (NGN) currency exchange rates from all sources/markets commonly used in Nigeria with legenda46.site app. You can track and. Get US Dollar/Nigerian Naira FX Spot Rate (NGN=:Exchange) real-time stock quotes, news, price and financial information from CNBC. The average US Dollar to Nigerian Naira exchange rate for the last six months was 1 USD = 1, NGN. Why Trust Us? legenda46.site has been. Convert Nigerian Naira to US Dollar ; 1 NGN, USD ; 5 NGN, USD ; 10 NGN, USD ; 25 NGN, USD. Free realtime forex chart for USDNGN (US Dollar / Nigeria Naira) foreign exchange, including easily-selectable and configurable technical indicators for. As on 01 Sep , the Conversion Rate for 1 NGN (NAIRA) is USD (Dollar) today. Other Calculators. NGN to USD Conversion Table · 1 Nigerian Naira, United States Dollar · 2 Nigerian Naira, United States Dollar · 3 Nigerian Naira. Our Dollar to Nigerian Naira conversion tool gives you a way to compare the latest and historic interbank exchange rates for USD to NGN · Currency Menu. Daily US Dollar to Naira, USD to NGN, Foreign Exchange Market exchange rates, percentage changes, historical rate charts and currency converter. The Nigerian Naira is expected to trade at by the end of this quarter, according to Trading Economics global macro models and analysts expectations. NGNUSD Nigerian Naira US DollarCurrency Exchange Rate Live Price Chart ; NGNRUB, , , % ; NGNKRW, , , %. NGN to USD | historical currency prices including date ranges, indicators, symbol comparison, frequency and display options for Nigerian Naira/U.S. Dollar. As of today, at PM UTC one billion naira is equal to $, (USD) or six hundred twenty-eight thousand nine hundred twenty-six us dollars SGD Singapore Dollar · THB Thai Baht · USD US Dollar · ZAR South African Rand. What is OANDA's Currency Converter? OANDA's Currency Converter allows you to. naira to the U.S. dollar is approximately ₦ per 1 US dollar. According to a recent report by Naija News, the parallel market exchange rate of the naira. AUSTRALIAN DOLLAR - AUD; AZERBAIJAN MANAT - AZN; BAHAMIAN DOLLAR - BSD; BAHRAIN NIGERIAN NAIRA - NGN; NORWEGIAN KRONE - NOK; OMAN RIAL - OMR; PAKISTANI. Track and analyze Nigerian Naira (NGN) currency exchange rates from all sources/markets commonly used in Nigeria with legenda46.site app. You can track and. Dollar, , 15 Aug , History. Antigua and Barbuda, XCD, E.C. Dollar, , 15 Nigeria Naira, , 15 Aug , History. Niue, NZD, New Zealand Dollar. Today, Nigerian Naira is expected to rise against the US Dollar, as the forecast expects the USD/NGN exchange rate to move to ₦ 1, from the current rate.

Aws Projects For Intermediate

AWS Projects Ideas · 1. Launch a Serverless Web App · 2. Recognize and Identify Famous People Using Rekognition · 3. Create a Windows Virtual Machine and. AWS Challenge Labs-Intermediate · Gain a deeper understanding of AWS services and architectures · Develop practical skills through hands-on challenges and. 10 fun hands-on projects to learn AWS · 1. Launch a static website on Amazon S3 · 2. Use CloudFormation to Launch an Amazon EC2 Web Server · 3. Add a CI/CD. It will teach you AWS concepts, services, security, architecture, and pricing. In addition, this tutorial will help you prepare for the AWS Certified Cloud. While learning the fundamentals, you will explore tools and services offered by Amazon Web Services(AWS) through interactive, hands-on exercises. By the end of. Honorary mentions: · legenda46.site boot camps (ex: bloc, hack reactor e.t.c) student projects · 2. Ycombinator · legenda46.site Originally published at. In this article, I will give a little introduction to Amazon Web Services and share 5 simple and hands-on projects that you can work on to. What You Will Learn: AWS Fundamentals and setting up your AWS account. Infrastructure as Code (IAC) and automation using bash commands. Networking essentials in. Explore AWS Projects to enhance your skills. Gain hands-on experience and build job-ready abilities with guided tasks and real-world applications. AWS Projects Ideas · 1. Launch a Serverless Web App · 2. Recognize and Identify Famous People Using Rekognition · 3. Create a Windows Virtual Machine and. AWS Challenge Labs-Intermediate · Gain a deeper understanding of AWS services and architectures · Develop practical skills through hands-on challenges and. 10 fun hands-on projects to learn AWS · 1. Launch a static website on Amazon S3 · 2. Use CloudFormation to Launch an Amazon EC2 Web Server · 3. Add a CI/CD. It will teach you AWS concepts, services, security, architecture, and pricing. In addition, this tutorial will help you prepare for the AWS Certified Cloud. While learning the fundamentals, you will explore tools and services offered by Amazon Web Services(AWS) through interactive, hands-on exercises. By the end of. Honorary mentions: · legenda46.site boot camps (ex: bloc, hack reactor e.t.c) student projects · 2. Ycombinator · legenda46.site Originally published at. In this article, I will give a little introduction to Amazon Web Services and share 5 simple and hands-on projects that you can work on to. What You Will Learn: AWS Fundamentals and setting up your AWS account. Infrastructure as Code (IAC) and automation using bash commands. Networking essentials in. Explore AWS Projects to enhance your skills. Gain hands-on experience and build job-ready abilities with guided tasks and real-world applications.

Welcome to this step-by-step guide on developing an intermediate AWS project. In this article, we will walk you through the process of building a practical AWS. 5 Mini AWS Cloud Project Ideas ☁️ · Project #1: Host a website on AWS (Beginner) · Project #2: Visualize Data using Amazon QuickSight (Beginner) · Project #3. INTERMEDIATE or ADVANCED project. If it's something worth doing, I Here are three examples of mini projects, these are AWS ones, but you get the idea. Aws Real Time Projects For Practice · a) Simple Web Application with S3 and CloudFront: · 2) Intermediate Level Projects: · 3) Advanced Level. Hello Everyone ,. In this blog, I am going to share with you some project ideas I practiced during my AWS Certification Preparation Journey. Master AWS SageMaker Algorithms (Linear Learner, XGBoost, PCA, Image Classification) & Learn SageMaker Studio & AutoML. Expand your AWS cloud skills with our constantly-updated AWS learning library. Whether you're just finding your footing, interested in AWS certification. Top AWS Projects · 1) Deploys a windows virtual machine · 2) Create a Website on AWS · 3) Launch a Serverless web app · 4) Set up Kubernetes Clusters on Amazon EC2. Ultimately, AWS developers help businesses use Amazon's vast range of services. Though there are many use cases, common users of AWS include developers of cloud. This Advanced Architecting on AWS course covers how to build complex solutions & preps you for the AWS Certified Solutions Architect - Professional exam. 1. Automated Image Resizing and Transfer System Using AWS Services · 2. Efficient AWS Cost Management through Stale Resource Detection · 3. Serverless EC2. Hands-on Tutorials ; COMPUTE, CONTAINERS · Deploy a Web App on Nginx Server using AWS App Runner · 20 minutes ; FRONT-END WEB & MOBILE, DATABASES. Build a serverless streaming platform: Utilize Amazon Kinesis Video Streams for ingesting video data, Kinesis Data Streams for real-time. Learn AWS Projects From Basics In This Free Online Training. AWS Project Course Is Taught Hands-On By Experts. Best For Beginners. Enroll In AWS Project. Aws Project · Recommended stories · AWS — SNS Hands-on · Boost your Resume with these Five AWS Projects: Easy, Intermediate, and Expert Levels with · EC2 Auto. AWS Projects · PySpark Project-Build a Data Pipeline using Kafka and Redshift · AWS Snowflake Data Pipeline Example using Kinesis and Airflow · Build Real-Time. Associates, which are intended for Intermediate ( years experience) AWS Credits for proof-of-concept projects: You can contact Luke Chirhart. While learning the fundamentals, you will explore tools and services offered by Amazon Web Services(AWS) through interactive, hands-on exercises. By the end of. What You Will Learn: AWS Fundamentals and setting up your AWS account. Infrastructure as Code (IAC) and automation using bash commands. Networking essentials in. beginners and students, developing software systems, and leading software development teams. AWS (Amazon Web Services) skills to real-world projects.

Forgot To Pay Taxes

For taxes assessed on or after January 1, , the late payment penalty is 5% of the tax not paid by the original due date of the return. Beginning July 1. Key Takeaways: Most people have to pay taxes on their income, unless they make less than the standard deduction and meet other IRS requirements. Additionally, a non-filer who voluntarily files their missing tax return is not likely to be charged. Anyone can unintentionally fall behind on paying taxes. So, you will owe a total penalty of 25 percent of any tax not paid. A percent penalty is also charged if you do not file a return for three consecutive. So, you will owe a total penalty of 25 percent of any tax not paid. A percent penalty is also charged if you do not file a return for three consecutive. A penalty may be imposed on unpaid income tax, including unpaid estimated income tax, equal to 15% of the amount not timely paid. You will owe a late-payment penalty for unpaid tax if you do not pay the tax you owe by the original due date of the return, even if you have an extension of. If your return or payment is late and you feel you have a qualifying situation, you may request to have the penalty waived. Delinquent tax collection process. If you are paying the tax over 30 days late, add a 10% penalty. If you are paying the tax after the date referenced on the Notice of Tax/FEE Due, add an. For taxes assessed on or after January 1, , the late payment penalty is 5% of the tax not paid by the original due date of the return. Beginning July 1. Key Takeaways: Most people have to pay taxes on their income, unless they make less than the standard deduction and meet other IRS requirements. Additionally, a non-filer who voluntarily files their missing tax return is not likely to be charged. Anyone can unintentionally fall behind on paying taxes. So, you will owe a total penalty of 25 percent of any tax not paid. A percent penalty is also charged if you do not file a return for three consecutive. So, you will owe a total penalty of 25 percent of any tax not paid. A percent penalty is also charged if you do not file a return for three consecutive. A penalty may be imposed on unpaid income tax, including unpaid estimated income tax, equal to 15% of the amount not timely paid. You will owe a late-payment penalty for unpaid tax if you do not pay the tax you owe by the original due date of the return, even if you have an extension of. If your return or payment is late and you feel you have a qualifying situation, you may request to have the penalty waived. Delinquent tax collection process. If you are paying the tax over 30 days late, add a 10% penalty. If you are paying the tax after the date referenced on the Notice of Tax/FEE Due, add an.

Several scenarios can lead to penalties and interest charges. The two main ones are filing your tax return late and paying your taxes late. The IRS often. Penalties ; Late Filing · 5% of the tax not paid by the original due date, and an additional 5% for each additional month the return is late. 25% of the tax due*. Even if you filed everything correctly (and on-time) you can still face penalties for not paying the correct amount for your tax dues. Underpayment penalties. Late payment penalty is double the amount owed accrued from interest rate charged on unpaid tax. •. Late filing penalty is $50 dollars for each month the return. If you haven't filed taxes in years, it is possible that you will be in trouble and have to pay the balance of what you owe, plus penalties and. Failure to pay withholding tax to the PA Department of Revenue on or before the due date for filing the quarterly reconciliation return will result in an. Late payment penalty is double the amount owed accrued from interest rate charged on unpaid tax. •. Late filing penalty is $50 dollars for each month the return. Late Payment Penalty. If you file your return within 6 months after the due date but do not pay the tax due until after that time, your return will be. Electronic funds transfer (EFT) payments. If you pay your taxes by EFT, your payment must settle into our bank account by the first banking day following. You will owe a late-payment penalty for underpayment of estimated tax if you were required to make estimated payments and failed to do so, or failed to pay the. Call them. They'll send you all your w2s from the year you missed. Then you have to file those taxes. Your account will be processed and put up. Late Payment and Failure to Withhold or Collect Tax as Required by Law - Two (2) percent of the total tax due for each 30 days or fraction thereof that a. The late payment penalty is.5 percent of the tax due on the return each month or fraction of a month the payment is late. Please see here for more information. In addition to interest charged on any tax due, you could face separate penalties for both filing and paying late. The late filing penalty is 5% of the tax due. These penalties can get up to 25% of your unpaid tax liability, and interest accrues on your unpaid taxes until you pay them. When you don't file a tax return. Penalty is 5% of the total unpaid tax due for the first two months or portion thereof. After two months, 5% of the unpaid tax amount is assessed each month. What happens if you don't file taxes? Failing to file a tax return because you forgot about the deadline, had a death in the family or were dealing with. Failure to pay withholding tax to the PA Department of Revenue on or before the due date for filing the quarterly reconciliation return will result in an. You can refile your taxes if you need to make a change or forgot to add something. You can file an amended return using Form X. Form X is available on. Virginia grants an automatic 6-month extension to file your individual income tax return. However, the extension does not apply to paying any taxes you owe.

Can I Borrow From My Roth Ira Without Penalty

Under the Roth IRA rules, you can access your contributions (but not your earnings) at any time without tax or penalty. The same provision does not exist for. Qualified withdrawals of Roth IRA contributions are always tax-and penalty-free. However, any earnings withdrawn early could be subject to both taxes and. You can receive distributions from your traditional IRA before age 59 1/2 without paying the 10% early withdrawal penalty. To do so, one of these exceptions. As with an early withdrawal, you may be subject to federal and state income taxes, as well as an additional 10% federal income tax if you are under age 59½. Unlike a k, you can't technically borrow against a Traditional or Roth IRA without avoiding an early withdrawal tax. Unlike traditional IRAs, you aren't required to take minimum distributions (RMDs) from a Roth IRA when you reach a certain age. If you don't need the money, you. With a Roth IRA, you can pull out the money from the account any time you want without any tax or penalty. You can withdraw contributions at any time without tax or penalty. But in most cases, you'll need to wait until you turn 59 ½ and have had the Roth account open. Under the following circumstances, you can withdraw money without penalty if you are using funds to: Purchase your first home; Cover qualified educational. Under the Roth IRA rules, you can access your contributions (but not your earnings) at any time without tax or penalty. The same provision does not exist for. Qualified withdrawals of Roth IRA contributions are always tax-and penalty-free. However, any earnings withdrawn early could be subject to both taxes and. You can receive distributions from your traditional IRA before age 59 1/2 without paying the 10% early withdrawal penalty. To do so, one of these exceptions. As with an early withdrawal, you may be subject to federal and state income taxes, as well as an additional 10% federal income tax if you are under age 59½. Unlike a k, you can't technically borrow against a Traditional or Roth IRA without avoiding an early withdrawal tax. Unlike traditional IRAs, you aren't required to take minimum distributions (RMDs) from a Roth IRA when you reach a certain age. If you don't need the money, you. With a Roth IRA, you can pull out the money from the account any time you want without any tax or penalty. You can withdraw contributions at any time without tax or penalty. But in most cases, you'll need to wait until you turn 59 ½ and have had the Roth account open. Under the following circumstances, you can withdraw money without penalty if you are using funds to: Purchase your first home; Cover qualified educational.

With a Roth IRA, contributions are made with after-tax dollars and are not tax-deductible. Distributions from Roth IRAs are free of federal taxes and may be. Qualified distributions, which are tax-free and not included in gross income, can be taken when your account has been opened for more than five years and you. IRAs do not allow for loans. However, funds withdrawn and repaid into the IRA account within 60 days avoid the IRS penalty. Note that the IRS allows only one. While IRA plans don't allow loans, there are ways to get money out of your traditional or Roth IRA account in the short term without paying a penalty. While IRA plans don't allow loans, there are ways to get money out of your traditional or Roth IRA account in the short term without paying a penalty. You can receive distributions from your traditional IRA before age 59 1/2 without paying the 10% early withdrawal penalty. To do so, one of these exceptions. Can I move my money to another IRA? You're able to transfer funds in your OregonSaves account to another IRA without incurring a penalty or paying taxes, as. Roth conversions are also eligible to be withdrawn without penalty or taxes, as long as they have been in your Roth for 5 years. Keep in mind, if you have done. However, taxes will be due on the withdrawal amount in the year taken. Roth IRA withdrawals- Contributions to a Roth IRA can be taken out penalty-free for. Be aware that there could be tax and penalty implications. If you take money out of your CalSavers Roth IRA and you don't meet the criteria for a qualified. Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. But if you're under age 59½ and your withdrawal dips into your earnings—in. A qualified plan may, but is not required to provide for loans. If a plan provides for loans, the plan may limit the amount that can be taken as a loan. The. Yes it can be done - per the IRS (legenda46.site). Although, depending on the amount of loans you are looking to pay (few. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. Taxable, but not subject to 10% early withdrawal penalty if under age 59 ½. Taxable and 10% early withdrawal penalty may apply if under age 59 ½. Required. If you're at least age 59½ and your Roth IRA has been open for at least five years, you can withdraw money tax- and penalty-free. See Roth IRA withdrawal rules. Unlike traditional IRAs, you aren't required to take minimum distributions (RMDs) from a Roth IRA when you reach a certain age. If you don't need the money, you. You can also borrow from your (k). Penalty-free Withdrawals from Individual Retirement Plans. Normally, if you withdraw money from a traditional or Roth IRA. Similar to other retirement plans, you can withdraw from an IRA at age penalty fee, although there are some exceptions to IRA early withdrawal rules. Roth IRA: Ability to withdraw contributions (not earnings) without incurring a 10% early withdrawal penalty. Penalties from early distribution from (k) or.

Best Method Of Paying Off Credit Card Debt

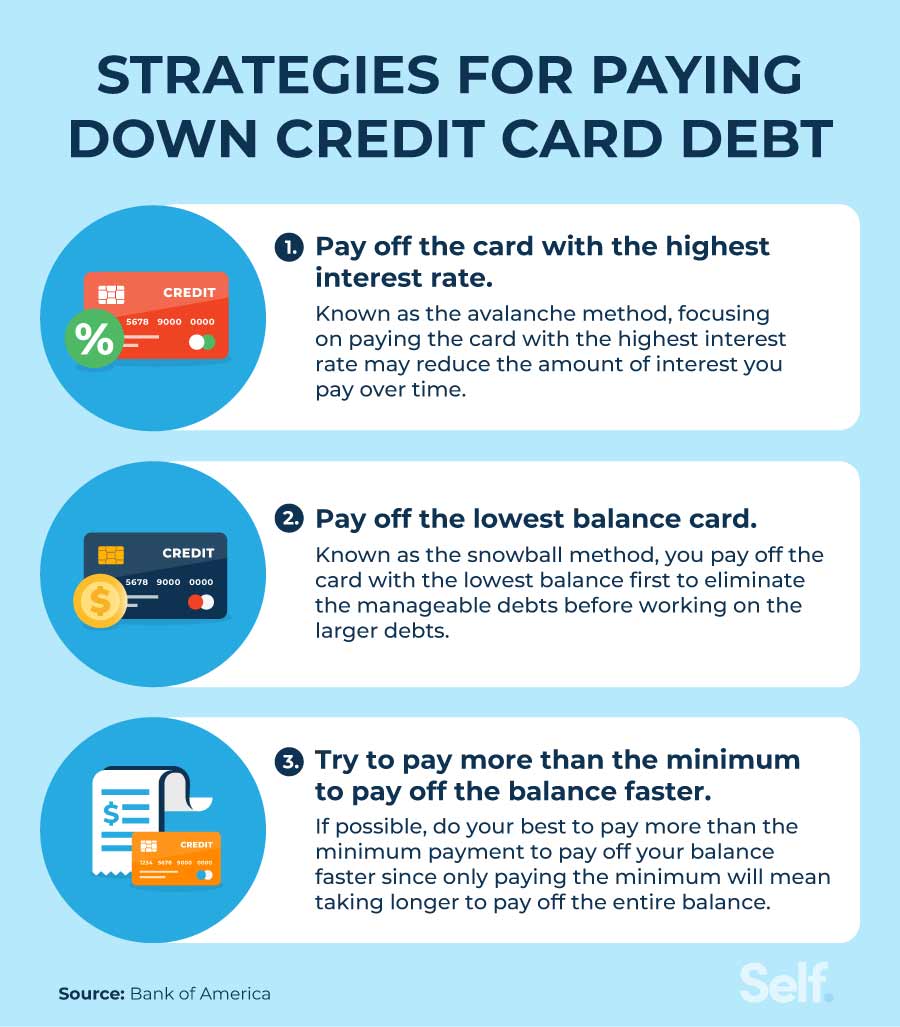

What to Do · List your credit cards from lowest balance to highest. · Pay only the minimum payment due on the cards with larger balances. · Pay additional on the. If you have multiple credit cards, make at least the minimum payment on each. Then, put as many extra funds as you can towards the card with the highest. The "snowball method," simply put, means paying off the smallest of all your loans as quickly as possible. Once that debt is paid, you take the money you were. 10 Tips for Paying Off Credit Card Debt · 1. Set a Goal Start by Setting a Goal You Can Achieve · 2. Put Your Credit Cards on Ice Yes, We Mean That Literally · 3. If you owe money on your credit cards, the wisest thing you can do is pay off the balance in full as quickly as possible. Virtually no investment will give you. Avalanche method: focus on highest interest · Make the minimum payment on all your cards to avoid late fees and finance charges. · Pay extra on your credit card. 2. Consider debt payoff strategies · Pay off high-interest debts first. Using a strategy called the debt avalanche method, you make the minimum payments on all. Make timely payments. Always send your payments on time. Creditors often penalize late payments with a higher interest rate – meaning more of your payment. Mathematically, paying off card 1 will be by far the best option. That interest rate basically means you'll he paying them $3k in interest this. What to Do · List your credit cards from lowest balance to highest. · Pay only the minimum payment due on the cards with larger balances. · Pay additional on the. If you have multiple credit cards, make at least the minimum payment on each. Then, put as many extra funds as you can towards the card with the highest. The "snowball method," simply put, means paying off the smallest of all your loans as quickly as possible. Once that debt is paid, you take the money you were. 10 Tips for Paying Off Credit Card Debt · 1. Set a Goal Start by Setting a Goal You Can Achieve · 2. Put Your Credit Cards on Ice Yes, We Mean That Literally · 3. If you owe money on your credit cards, the wisest thing you can do is pay off the balance in full as quickly as possible. Virtually no investment will give you. Avalanche method: focus on highest interest · Make the minimum payment on all your cards to avoid late fees and finance charges. · Pay extra on your credit card. 2. Consider debt payoff strategies · Pay off high-interest debts first. Using a strategy called the debt avalanche method, you make the minimum payments on all. Make timely payments. Always send your payments on time. Creditors often penalize late payments with a higher interest rate – meaning more of your payment. Mathematically, paying off card 1 will be by far the best option. That interest rate basically means you'll he paying them $3k in interest this.

1: Cut up the cards. Stop charging purchases, use cash or debit. · 2: Pay more than minimum to just one CC company. this pays that card off. Prioritizing debt by balance size. This strategy, also called the snowball method, prioritizes your debt payments from smallest to largest. You'll continue to. Try to pay what you can afford towards your credit card. More interest is added as the balance gets bigger. Try to keep your balance low. Studies now suggest that paying off your debts from smallest to largest (the debt snowball method) can be more beneficial than paying off the one with the. 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at a time. · 4. Consolidate credit card debt. · 5. Learn about two popular strategies for paying off debt—the snowball method and the high rate method—so you can chart a course to being out of debt once and for. So, how do you increase your credit score? Paying your bills on time and lowering your debt burden are the two best solutions, but there are more ways to. Tips for paying off debt · Pay more than the legenda46.site · Pay more than once a legenda46.site · Pay off your most expensive loan legenda46.site · Consider the. Consider setting up automatic transfers to your savings account every payday. That way, you can put aside money for your card payments before you have a chance. This is the best dollars-and-cents approach. 1. List your credit cards from highest interest rate to lowest. 2. Pay only the minimum payment due on. With the debt snowball, you pay off your smallest debts first. With the debt avalanche, you pay off debts with the highest interest rates first. The debt avalanche and the debt snowball methods are two strategies for paying down debt. With the debt avalanche method, you pay off the high-interest debt. The best way to pay down credit cards is to start with the lowest balance and work your way up. However, there are other tactics you can take as well. For those who qualify, using a balance transfer card is the most active approach to paying off your credit card debt because it involves moving your debt to a. Avalanche method: pay highest APR card first Paying off your credit card with the highest APR first, and then moving on to the one with the next highest APR. Know your budget · List out your credit card debts, minimum payments, and APR · Select a credit card debt reduction strategy: snowball method vs. · Automate your. The way the snowball debt strategy works is actually quite simple. Start by ranking your debts in order by the amount you owe, from smallest to largest. Next. How To Pay off Credit Card Debt · 5 Steps To Assess Your Spending · Commit to a Payment Amount · Choose a Payment Strategy · Consider Balance Transfer Credit Cards. The debt snowball method recommends paying your credit cards off from smallest to largest. Since smaller balances take less time to pay off, you will see. Know your budget · List out your credit card debts, minimum payments, and APR · Select a credit card debt reduction strategy: snowball method vs. · Automate your.

What Is Vehicle Finance Interest Rate

Auto Loan Rates ; Credit score range. Average interest rate ; to % ; to % ; to % ; to %. The answer will depend primarily on your credit. Those with great credit may be able to get a car loan rate between 3% and 4%. What Is the Interest Rate on a Car Loan? It's what a lender charges you for a loan to buy a car. A percentage of the loan amount, it represents what you'll pay. The calculation is an estimate of what you will pay towards an auto loan. Use the amount as a reference or guideline; it may not be the same amount you receive. Loan Amount: · $5k. $k ; Interest Rate: %. %. 8% ; Term: 45 Months. 6mo. 48mo. Shop, finance and drive. Find the car and financing that's right for you. Get a fast credit decision, competitive rates with a 30 day rate lock. Auto Loan Rates ; Credit score range. Average interest rate ; to % ; to % ; to % ; to %. One of the main factors lenders consider when you apply for a loan is your credit score. A higher score can help you secure a better interest rate—which means. Auto Loan Rates ; New Standard APR · %, % ; Used Standard APR · %, %. Auto Loan Rates ; Credit score range. Average interest rate ; to % ; to % ; to % ; to %. The answer will depend primarily on your credit. Those with great credit may be able to get a car loan rate between 3% and 4%. What Is the Interest Rate on a Car Loan? It's what a lender charges you for a loan to buy a car. A percentage of the loan amount, it represents what you'll pay. The calculation is an estimate of what you will pay towards an auto loan. Use the amount as a reference or guideline; it may not be the same amount you receive. Loan Amount: · $5k. $k ; Interest Rate: %. %. 8% ; Term: 45 Months. 6mo. 48mo. Shop, finance and drive. Find the car and financing that's right for you. Get a fast credit decision, competitive rates with a 30 day rate lock. Auto Loan Rates ; Credit score range. Average interest rate ; to % ; to % ; to % ; to %. One of the main factors lenders consider when you apply for a loan is your credit score. A higher score can help you secure a better interest rate—which means. Auto Loan Rates ; New Standard APR · %, % ; Used Standard APR · %, %.

Explore car loan rates ; New/Used Cars, and newer models, Up to 63 months, As low as % ; New/Used Cars, and newer models, 64 to 75 months, As low as. An interest rate below % for a new and % for a used car can be considered good for a month car loan. What credit score do you need to buy a 50k. Compare up to three finance options: ; Rate (percentage) e.g. % ; Term (months) e.g. Refinancing could lower your interest rate, decrease your monthly payment or both. Opportunity to get $ when you refinance your auto loan from another lender. We can help you finance it at a perfect rate. We offer interest rates as low as % so you can save money while getting all the best new features. Auto Loans Interest Rates ; Certified Pre-owned Car Loan Scheme. From % to % (CIC Based rates are applicable). ; SBI Two-Wheeler Loan. % to %. This finance charge includes interest and any fees for arranging the loan. The charge gets added to the amount you borrow, and you repay the combined total. You've found the perfect car and we can help you finance it at a perfect rate. We offer interest rates as low as % so you can save money while getting. Auto Loans Interest Rates ; Certified Pre-owned Car Loan Scheme. From % to % (CIC Based rates are applicable). ; SBI Two-Wheeler Loan. % to %. Fixed auto loan interest rates as low as % APR¹ with MyStyle® Checking discount · No application fees · Terms up to six years² · Onsite financing—tell the. Auto Loan Rates It's Time to Rev Up The Savings!!! Finance your NIHFCU Online Car Buying Service purchase with us and get a rate as low as % APR plus a The best interest rate on a car loan is the lowest one you can get, but watch out for fees that will drive up your cost. With a lower interest rate, you'll save. Auto loan interest is the extra cost in addition to your loan principal — your starting loan amount — that lenders charge you for borrowing money. Your interest. Average Auto Loan Rates in July ; Average Auto Loan Rates for Excellent Credit · or higher, %, %, % ; Average Auto Loan Rates for Good Credit. Our free car loan calculator generates a monthly payment amount and total loan cost based on vehicle price, interest rate, down payment, sales tax, fees and. As of , the average interest rate for car loans was percent for new cars and percent for used cars. However, these rates are just averages—you. July Car Loan Rates (APR) in the U.S. for Used and New Cars · 9% - % · 10% - % · 11% - % · >12%. Interest rates. Car loan APRs range from % APR to % APR when you use Auto Pay. Applicants receive a fast credit. Rates for Recreational Vehicles ; Vehicle Type: New Boats, Motors, Trailers. APR: % to % ; Vehicle Type: Used Boats, Motors, Trailers. APR: % to. The best rates for an auto loan can vary significantly, depending on your credit score. (For example, anywhere from % to % for a new vehicle and %.

Free Health Plan Apps

This mobile app is for UPMC Health Plan insurance members only. Not a UPMC Health Plan member? Learn more about plans, services, and benefits of membership. Meet healthy eating goals one at a time! Use the Start Simple with MyPlate app to pick simple daily food goals, see real-time progress, and earn badges along. The UPMC Health Plan mobile app puts your health insurance information in the palm of your hand. It offers convenient on-the-go access to your health insurance. Medicaid and the Children's Health Insurance Program (CHIP) provide free or low-cost health coverage to millions of Americans, including some low-income. What is the difference between the free Fitbit app and Fitbit Premium? The free Fitbit app Health Plans · Workforce Health · Health Systems · Researchers. Excel can help you plan, track, and organize your health and fitness goals with a robust offering of free and premium templates. Reach your health, fitness & weight goals with MyFitnessPal, the #1 nutrition tracking app. Macro & calorie calculator, food tracker, and fasting app in one. Download our free app to simplify your health care experience. With the app, you can access member ID cards, chat with Member Services, and more! Health Planner & Tracker is an all-in-one application designed to support your holistic well-being by providing a comprehensive array of features and tools. This mobile app is for UPMC Health Plan insurance members only. Not a UPMC Health Plan member? Learn more about plans, services, and benefits of membership. Meet healthy eating goals one at a time! Use the Start Simple with MyPlate app to pick simple daily food goals, see real-time progress, and earn badges along. The UPMC Health Plan mobile app puts your health insurance information in the palm of your hand. It offers convenient on-the-go access to your health insurance. Medicaid and the Children's Health Insurance Program (CHIP) provide free or low-cost health coverage to millions of Americans, including some low-income. What is the difference between the free Fitbit app and Fitbit Premium? The free Fitbit app Health Plans · Workforce Health · Health Systems · Researchers. Excel can help you plan, track, and organize your health and fitness goals with a robust offering of free and premium templates. Reach your health, fitness & weight goals with MyFitnessPal, the #1 nutrition tracking app. Macro & calorie calculator, food tracker, and fasting app in one. Download our free app to simplify your health care experience. With the app, you can access member ID cards, chat with Member Services, and more! Health Planner & Tracker is an all-in-one application designed to support your holistic well-being by providing a comprehensive array of features and tools.

Happify: Some free content, including stress reduction and cognitive techniques to address anxiety. MindShift CBT: Free content, including cognitive behavioral. I like the Samsung health app. It has Calorie counting and free Plus, I don't have time to plan that much. I've been using. Nutrition is the key to a healthier weight, better mood, restful sleep, and longevity. Get the free Lifesum app plans to suit your lifestyle. Healthy. Personalized workout programs and meal plans in one easy to use health and wellness digital platform. Smartphone apps make taking care of yourself easier than ever, helping you relax, exercise, diet, sleep, track hormones, stop smoking, manage asthma, and. Try Calm and Headspace Care at no cost. These apps, recommended by Kaiser Permanente clinicians, help with sleep, stress, anxiety, and more. Eat healthy, home-cooked meals, and save $s with our easy-to-use meal planning app. Delicious recipes. Personalized meal plans. Smart grocery list. 5 Best Free Health & Fitness Apps to Stick to Your Resolutions · 1. MyFitnessPal. If you're looking for a little of everything in a free fitness app. Some benefits are free, and some may have co-pays and co-insurance. Washington Apple Health: The public health insurance programs for eligible Washington. Are you looking for the best free fitness apps to help you reach your health plans and nutrition tracking, to community support and. The UPMC Health Plan app is free and available 24/7. Use your UPMC Health Plan Login for access. Download the UPMC Health Plan app today! healthy recipes, and more, all for free. While free content is abundant app for planning your training, doing workouts, and eating healthy. You can. Download it: iOS | Android; Price: Free to download. With HealthTap Basic, you can pay $99 or less per urgent care visits. HealthTap subscribers (as low as. More ways to kickstart your health · NHS Food Scanner app · NHS Weight Loss Plan · Couch to 5K app · Active 10 app · Drink Free Days app · NHS Quit Smoking app · BMI. MyFitnessPal is one of the most popular health apps around. “[It] offers significant functionality for tracking, so you're able to locate lots of products with. Take steps to improve your health. Lose weight and feel better inside and out. Try our free NHS weight loss plan to get you started. app app; Samsung Health Samsung Health. Footer Navigation. Shop. open. Phones Free standard shipping, exclusive offers and financing options. GET. ×. The. app with food data logged in an iPhone. Top Rated Weight Loss Plan. Track the foods you love and lose weight. Sign Up for Free. Weight Loss Made Easy. Set Your. Manage your health from the palm of your hand · Calm. This app features meditation techniques for sleep and stress reduction, including timed breathing and. Learn how to apply and what to do if you need help with your application Their help is free. Visit a local Oregon Department of Human Services office.

How Do I Buy A Home For The First Time

Step 1 Getting Pre-Qualified for a Mortgage · Step 2 Developing your First Time Home Buyer Wish List · Step 3 Picking Your Team · Step 4 House Hunting for First. First Time Home Buyer Checklist ; Step1: Prepare: figure out what home you can afford · Pre-qualification: ready to buy ; Step 2: Shop for a Home. Take pictures. Start by getting pre-approved for a mortgage so you know your budget. Take a first-time homebuyer class to understand the process. Interview a. Buying a house for the first time is a major life decision. Most traditional loans carry a term of 15 to 30 years, and you need to be sure you're ready to. Are you tired of paying rent every month with nothing to show for it? Then it could be time to buy your first home! Owning a home has a lot of perks. The most. First Time Home Buyer Steps to a Successful Home Purchase: · SAVE: You'll need money for a down payment, closing costs and escrow for insurance and taxes. Homeownership vouchers for first-time homebuyers If you have a low income and want to buy your first home, the Housing Choice Voucher homeownership program. First-time home buyer seminars are offered by a range of organizations, including city housing departments and non-profit organizations. You'll get tips on. 1. Start Saving Early · 2. Start Working on Your Credit Score as Soon as Possible · 3. Try Not to Finance Anything New Before Buying a Home · 4. Decide How Much. Step 1 Getting Pre-Qualified for a Mortgage · Step 2 Developing your First Time Home Buyer Wish List · Step 3 Picking Your Team · Step 4 House Hunting for First. First Time Home Buyer Checklist ; Step1: Prepare: figure out what home you can afford · Pre-qualification: ready to buy ; Step 2: Shop for a Home. Take pictures. Start by getting pre-approved for a mortgage so you know your budget. Take a first-time homebuyer class to understand the process. Interview a. Buying a house for the first time is a major life decision. Most traditional loans carry a term of 15 to 30 years, and you need to be sure you're ready to. Are you tired of paying rent every month with nothing to show for it? Then it could be time to buy your first home! Owning a home has a lot of perks. The most. First Time Home Buyer Steps to a Successful Home Purchase: · SAVE: You'll need money for a down payment, closing costs and escrow for insurance and taxes. Homeownership vouchers for first-time homebuyers If you have a low income and want to buy your first home, the Housing Choice Voucher homeownership program. First-time home buyer seminars are offered by a range of organizations, including city housing departments and non-profit organizations. You'll get tips on. 1. Start Saving Early · 2. Start Working on Your Credit Score as Soon as Possible · 3. Try Not to Finance Anything New Before Buying a Home · 4. Decide How Much.

Many first-time homebuyers are able to finance their homes using low down payment options. These make it possible to get loans with a minimum down payment as. Realtors can educate you on the many financial complexities that come with buying a home, and they'll provide honest advice during your search. There are. Find out if you qualify for down payment assistance programs, mortgage revenue bonds, or other programs designed to reduce the up-front cost of buying a home. Important Questions you need to ask yourself · Work On Your Credit · Pay Down Debt · BEST Loan programs and Down Payments available for first time home buyers · Get. Be a first-time homebuyer · Complete a homebuyer education course taught by an HPD-approved counseling agency · Work with an HPD approved Housing Counseling. Whether you want to move out of your parents' home for the first time, own a home after renting for years or buy a place with a spouse or partner, purchasing. Are you tired of paying rent every month with nothing to show for it? Then it could be time to buy your first home! Owning a home has a lot of perks. The most. How To Buy Your First House · Start saving · Calculate a down payment · Figure out a budget · Qualify for a mortgage · Factor in all your costs · Look into mortgage/. Find out if you qualify for down payment assistance programs, mortgage revenue bonds, or other programs designed to reduce the up-front cost of buying a home. First Time Home Buyer Checklist ; Step1: Prepare: figure out what home you can afford · Pre-qualification: ready to buy ; Step 2: Shop for a Home. Take pictures. This guide will provide you with tips and strategies for your home-buying journey. A few of the topics covered in this guide include: how to find your dream. GTranslate · 1. Figure out how much you can afford · 2. Know your rights · 3. Shop for a loan · 4. Learn about homebuying programs · 5. Shop for a home · 6. Make an. For first-time buyers who qualify, the government provides 5% or 10% of the price of a home, depending on the type of property. The incentive is like a second. Once you know what you qualify for, save time and energy by narrowing your search to homes that fit your financial criteria. Try to preview properties online. There are several key criteria used to qualify as a first-time homebuyer. · You must be a first-time home buyer, a veteran or someone who hasn't owned a home in. Before buying, ensure you visit the neighborhood at different hours of the day. This gives you a better idea of neighbors, noise factors and the. Steps to Home Ownership for First-Time Buyers · Educate yourself & set your homebuying budget · Explore Down Payment Assistance & the benefits of a MassHousing. Here we break down the home-buying process step-by-step to help you easily navigate through it all like a pro. Most traditional home loans require 20% of the home's purchase price upfront, while other types of mortgages, like an FHA loan, require much less. Regardless. Here we break down the home-buying process step-by-step to help you easily navigate through it all like a pro.

How Much Is A Pos System For A Restaurant

1. Lightspeed Lightspeed's POS solution is an iPad-based system that works for quick-service and full-service restaurants. A mobile POS, Lightspeed supports. TouchBistro pricing starts at $69/month with flexible plans for every type of restaurant. Get more details and a free quote today. Retail and Restaurant POS Terminal Machine for Small Business, Point of Sale Cash Register with Android 11 OS, " Touch Screen, White, Hardware Only. -The average cost is $ to $1, -Some POS systems have monthly service fees and fees for each transaction. What Do POS Systems Mean For A Restaurant? hello. Best iPad POS for QSR, Restaurants, and Bars. TouchBistro is an all-in-one POS and restaurant management system designed to make your restaurant run easier. The. A3 Point of Sale Touch System Cash Register POS Software for Retail Stores or Restaurant Restaurant,Supermarket,Jukebox and Many Other Hospitality. Initial Costs · Hardware Costs: For a basic setup (a terminal, cash drawer, receipt printer, and card reader), costs can range from $ to over. Lightspeed Restaurant POS requires 40% fewer clicks for completing check splitting, discounting and other basic POS workflows than certain industry-leading POS. It's about $ USD depending on the number of systems, printers and whatnot. A lot of smaller restaurants opt for the $/month instead. 1. Lightspeed Lightspeed's POS solution is an iPad-based system that works for quick-service and full-service restaurants. A mobile POS, Lightspeed supports. TouchBistro pricing starts at $69/month with flexible plans for every type of restaurant. Get more details and a free quote today. Retail and Restaurant POS Terminal Machine for Small Business, Point of Sale Cash Register with Android 11 OS, " Touch Screen, White, Hardware Only. -The average cost is $ to $1, -Some POS systems have monthly service fees and fees for each transaction. What Do POS Systems Mean For A Restaurant? hello. Best iPad POS for QSR, Restaurants, and Bars. TouchBistro is an all-in-one POS and restaurant management system designed to make your restaurant run easier. The. A3 Point of Sale Touch System Cash Register POS Software for Retail Stores or Restaurant Restaurant,Supermarket,Jukebox and Many Other Hospitality. Initial Costs · Hardware Costs: For a basic setup (a terminal, cash drawer, receipt printer, and card reader), costs can range from $ to over. Lightspeed Restaurant POS requires 40% fewer clicks for completing check splitting, discounting and other basic POS workflows than certain industry-leading POS. It's about $ USD depending on the number of systems, printers and whatnot. A lot of smaller restaurants opt for the $/month instead.

Chameleon is one of the most user-friendly restaurant POS software when it comes to types of POS systems for restaurants. Its sleek interface is easy to. We'll give you a comparison of the pricing and functionality of several popular restaurant systems to help you make your decision. Best iPad POS for QSR, Restaurants, and Bars. TouchBistro is an all-in-one POS and restaurant management system designed to make your restaurant run easier. The. A point-of-sale system, or POS system, is a piece of technology that serves as a central hub for taking and managing all transactions within your restaurant. Software Costs: Pricing can range from $0 for basic, limited-feature versions to $$ per month for more advanced, cloud-based systems. TouchBistro pricing starts at $69/month with flexible plans for every type of restaurant. Get more details and a free quote today. A POS, or point-of-sale, system is a combination of hardware and software designed to ring up sales and process payments. Retailers, restaurant owners and. Book a hassle-free demo to see how our restaurant technology and marketing services can help you run a profitable quick service restaurant, coffee shop, or food. Orders go through the Point Of Sale POS system, directly to the kitchen printer, as well as Kitchen Display Systems (KDS) as may be applicable. A restaurant . A restaurant POS system combines traditional POS system hardware and software with additional features needed for restaurant operations. · Restaurant POS systems. Toast offers flexible pricing plans for every restaurant type, size, and layout. Build the specific hardware, software package that fits your restaurant. POS software can cost as little as $10 or as much as $ per month, depending on the features you want. Lightspeed POS can work for businesses of varying sizes, including enterprise clients like major restaurant chains. With Lightspeed, you can open tabs. Better margins, improved efficiencies, more accurate inventory management and less overall waste. Plus, if you choose a restaurant POS system that integrates. You can think of a POS system as the externalized brain of the restaurant. It includes both hardware and software that runs on computers and mobile devices. $75 per device/month; $25 for KDS software. 3. Additional POS features. The purpose of a restaurant POS system. Deliver a quick-service experience that keeps your customers coming back with a tablet-based POS system that delivers everything you need to get started. This. TouchBistro is our best POS pick for restaurants since its features make good on its intent to primarily serve restaurants. With TouchBistro you can split. Foodics is one of the best restaurant POS systems that is cloud-based and provides businesses with comprehensive data and reports on their daily operations. The. These are the main components of a restaurant POS system, which includes a monitor, cash drawer, and credit card reader. The cost range for a basic POS terminal.

Investment Project Ideas

There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more. PPF is a trusted investment plan in India. Investments start at just Rs. per annum and the principal invested, interest earned, and maturity amount are all. A fun project to get students investing beyond securities (bonds, stocks, funds) into other exciting areas like real estate, collectibles, and even opening a. financial situation -- especially if you've never made a financial plan before. For more detailed information about topics discussed in this Investor. Money and idea balance. Investor compare business ideas and finance on scales. Buying creative project or startup, tiny human vector. Illustration idea. The objective is to identify investment opportunities which are feasible and promising. Generation of an idea of producing a new product, new business, requires. Following through on the wrong projects or business ideas can be a huge waste of time and money. May 31, - Explore Gg's board "Kids financial project", followed by people on Pinterest. See more ideas about kids, kids money, teaching. This project teaches students about the stock market through a workbook, guided activities, and discussions. It includes a teacher's guide. There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more. PPF is a trusted investment plan in India. Investments start at just Rs. per annum and the principal invested, interest earned, and maturity amount are all. A fun project to get students investing beyond securities (bonds, stocks, funds) into other exciting areas like real estate, collectibles, and even opening a. financial situation -- especially if you've never made a financial plan before. For more detailed information about topics discussed in this Investor. Money and idea balance. Investor compare business ideas and finance on scales. Buying creative project or startup, tiny human vector. Illustration idea. The objective is to identify investment opportunities which are feasible and promising. Generation of an idea of producing a new product, new business, requires. Following through on the wrong projects or business ideas can be a huge waste of time and money. May 31, - Explore Gg's board "Kids financial project", followed by people on Pinterest. See more ideas about kids, kids money, teaching. This project teaches students about the stock market through a workbook, guided activities, and discussions. It includes a teacher's guide.

legenda46.sitel Investment:Types of Capital Investment[Original Blog] · 1. Equity Capital. Equity capital is the most common type of capital investment in a startup. Outline your investment project goals, objectives, and strategies · Present a comprehensive financial analysis, including projected returns and risks · Showcase. Capital budgeting refers to the process we use to make decisions concerning investments in the long-term assets of the firm. The general idea is that the. This book guides the reader through all the stages of investment project design from the initial idea through cost-benefit analysis right up to implementation. Invest In An Asset That Pays You An Annuity. After an initial lump sum investment, an annuity plan can help you generate regular income for life. You can start many businesses by supplying or installing security roof hatches, cleaning after construction projects, and supplying raw materials to the. Investment Portfolios. 10x investment themes and priorities. We tackle the hardest problems, and while we've always pursued ideas on all topics and themes. financial situation -- especially if you've never made a financial plan before. For more detailed information about topics discussed in this Investor. Preparation of financial and other resources for the investment project. Selection of an investor and the search for borrowed resources through banks and IFIs. financial topics including business, investing, personal finance, and trading. Can invest in a single project or a portfolio of projects. Can diversify. Invest in properties with potential for adaptive reuse, such as converting old warehouses into trendy lofts. #AdaptiveReuse #PropertyConversion. Key Takeaways. Investing involves deploying capital (money) toward projects or activities expected to generate a positive return over time. The type of returns. Technology transfer is another popular path-to-market option; it enables quick monetization and frees inventors to concentrate on new projects. Tip. Small. How do I build my investment portfolio? · Consider investing in different asset classes such as stock, bonds, mutual funds, and ETFs. · Consider investing in. If you need money for business development, turn to investors for help. This web page allows you to publish your own project, so the capital owners are ableto. How to Write a Business Plan For Investors (That They Will Love) · 1. Executive Summary · 2. Investment Opportunity · 3. Team Overview · 4. Market Opportunity · 5. The unpredictability of financial markets can disrupt even the best-laid retirement plans. These five strategies may help investors stay on track. Read more. The World Bank provides low-interest loans, zero to low-interest credits, and grants to developing countries. These support a wide array of investments. Service · Washing cars · Housework · Teaching a hobby or skill · Helping with computers or other technology · Photo and video projects · Picture framing · Catering.