legenda46.site

Tools

Business Continuity Planning Definition

:max_bytes(150000):strip_icc()/Terms-b-business-continuity-planning-99a6b0cc671b4d009d536127e246ec5d.jpg)

A business continuity plan (BCP) is a documented strategy outlining procedures and protocols to ensure essential business functions can continue or be rapidly. A Business Continuity Plan (BCP) is a document that outlines how an organization will continue to operate during an unplanned event, such as a natural disaster. The documentation of a predetermined set of instructions or procedures that describe how an organization's mission/business processes will be sustained. Business continuity outlines exactly how a business will proceed during and following a disaster. It may provide contingency plans. A business continuity plan (BCP) is a set of procedures and policies that help protect a company's assets from natural or human-made threats that could disrupt. Business continuity planning aims to resume, recover and restore business operations. It also helps to soften the impact of both sudden and gradual disruptions. Business continuity is an organization's ability to maintain or quickly resume acceptable levels of product or service delivery following a short-term event. Contingency planning is a crucial part of continuity planning — it means having a backup if your original plan no longer works. It's your plan B. Your BCP. A business continuity plan (BCP) is a document that outlines how a business will continue operating during an unplanned disruption in service. A business continuity plan (BCP) is a documented strategy outlining procedures and protocols to ensure essential business functions can continue or be rapidly. A Business Continuity Plan (BCP) is a document that outlines how an organization will continue to operate during an unplanned event, such as a natural disaster. The documentation of a predetermined set of instructions or procedures that describe how an organization's mission/business processes will be sustained. Business continuity outlines exactly how a business will proceed during and following a disaster. It may provide contingency plans. A business continuity plan (BCP) is a set of procedures and policies that help protect a company's assets from natural or human-made threats that could disrupt. Business continuity planning aims to resume, recover and restore business operations. It also helps to soften the impact of both sudden and gradual disruptions. Business continuity is an organization's ability to maintain or quickly resume acceptable levels of product or service delivery following a short-term event. Contingency planning is a crucial part of continuity planning — it means having a backup if your original plan no longer works. It's your plan B. Your BCP. A business continuity plan (BCP) is a document that outlines how a business will continue operating during an unplanned disruption in service.

Business continuity is an organization's ability to maintain critical business functions during and after a disaster has occurred. Business continuity is the ability to allow your business to function, so that you can continue critical functions. If social media is used as a necessary. For purposes of planning at the University of Iowa, business continuity is defined as the continuity of critical functions following an incident that. Learn about business continuity and disaster recovery. Study the steps of business continuity planning, and identify the importance of a business. Business continuity planning (BCP) is a broad disaster recovery approach whereby enterprises plan for recovery of the entire business process. Objective of the business continuity planning process. Determine how your organization will maintain essential services and functions in the event of an. A business continuity plan (BCP) is a collection of procedures that establishes protocols and creates prevention and recovery systems in the case of a cyber. With this definition, understand what a business continuity plan is, and how to develop a BCP and the role of HA/DR solutions. Definition: A business continuity plan (BCP) is a comprehensive strategy of prevention and recovery designed to help organizations in maintaining their. Business Continuity Planning is the process of documenting how an organisation will respond to events that impact its operations. Business Continuity Management is defined as a holistic management process that identifies potential threats to an organization and the impacts to business. A business continuity plan gives an organization the ability to maintain essential processes before, during, and after a disaster. A business continuity plan is a framework that details what will happen in the event of a disruption to business operations. Business continuity is the ability to allow your business to function, so that you can continue critical functions. If social media is used as a necessary. A business continuity plan (BCP) can help keep your operations running smoothly, even during adversity like natural disasters, equipment failure, cyber-attacks. Business continuity and resiliency planning is the process of creating systems of prevention and recovery to deal with potential threats to a company. Business continuity plans are created before an incident takes place and involves key stakeholder's input. BCP plans attempt to define all risks that can. A: Restoring data from a backup system is an example of business continuity. If a critical system, such as ERP, goes down, a business continuity plan should. The core of this concept is the business continuity plan — a defined strategy that includes every facet of your organization and details procedures for. A business continuity plan (BCP) is a documented strategy outlining procedures and protocols to ensure essential business functions can continue or be rapidly.

How To Trade With Little Money

Open a position for less than the total value of your trade – this is also known as a 'leveraged' trade. For example, if you bought 10 CFDs on shares worth £ Earn while you spend % interest on unlimited cash. Make money every month. No monthly subscription fee. Unlimited free ATM withdrawals worldwide from In starting, invest only low amount,choose share smartly,don't do intraday trading without knowing the knowledge of technical analysis. While there are a few more moving parts to trading options than buying and selling stocks, options can be intuitive to trade and can even reduce your risk. And. Another important aspect of money management for traders is risk control. By setting stop losses and limiting their exposure, traders can protect their capital. Set orders to buy stock a little at a time, on a regular schedule, or only when it hits your target price. Alerts on market trends. Know what stock has been. How much money do you NEED to Day Trade?! As you may know, in January of , I funded an account with $ and began a Small Account Challenge. Within Option number one would be you trade with the cash account. So I know some of you guys are going to say, hey Ross, why go over here and trade off shore when you. You should also start with a small amount of money and gradually increase your investment as you become more experienced. Day trading guide for beginners. Open a position for less than the total value of your trade – this is also known as a 'leveraged' trade. For example, if you bought 10 CFDs on shares worth £ Earn while you spend % interest on unlimited cash. Make money every month. No monthly subscription fee. Unlimited free ATM withdrawals worldwide from In starting, invest only low amount,choose share smartly,don't do intraday trading without knowing the knowledge of technical analysis. While there are a few more moving parts to trading options than buying and selling stocks, options can be intuitive to trade and can even reduce your risk. And. Another important aspect of money management for traders is risk control. By setting stop losses and limiting their exposure, traders can protect their capital. Set orders to buy stock a little at a time, on a regular schedule, or only when it hits your target price. Alerts on market trends. Know what stock has been. How much money do you NEED to Day Trade?! As you may know, in January of , I funded an account with $ and began a Small Account Challenge. Within Option number one would be you trade with the cash account. So I know some of you guys are going to say, hey Ross, why go over here and trade off shore when you. You should also start with a small amount of money and gradually increase your investment as you become more experienced. Day trading guide for beginners.

Many people don't know that trading with no startup funds is possible. There is a common belief that to trade in the foreign exchange market, one should put in. Trade your favorite stocks anytime. The 24 Hour Market is here. Trade Get more crypto for your cash—and start with as little as $1. Buy, sell, and. Day trading doesn't just mean riding waves on domestic stocks; sometimes, emerging markets can provide volatility that few sectors in the U.S. can. EWZ tracks. trader-speak for losing more money than you have in your trading account. trade less frequently because it takes longer to complete their trades. For. However, before you decide to go all in, here are a few strategies that could help you trade easier. Both cash and margin accounts offer added flexibility. A wise choice is to start with the less volatile stocks. This may give you a slow start, but these stocks are more likely to sustain a good performance even in. You can start trading with an initial investment as low as $ However, the amount of money you start with is a significant determinant of your ultimate. How To Day Trade With Less Than $25, · Plan your trades · Trade other financial markets · Trade on foreign stock exchanges and with foreign brokerages · Split. To find an angle or approach you may need to spend a few hours in research each and every day. · You will probably have to pay a commission on each trade. · Day. Is it a Good Idea to Trade Forex with a Low Amount of Money? Trading forex with a small minimum deposit is a matter of how important the amounts are to you. Many online brokerages and trading platforms offer these tools, which allow you to place virtual trades using simulated market conditions. This allows you to. Another alternative with comparatively less capital expenditure is the Day trading. With day trading, traders rely on Stock market transactions that are already. trading success rate for trainees becoming consistently profitable traders was extremely low. For traders with little money, little help, or little time. As Instructed, I'm using paper money and it makes learning a lot less stressful. But I would love to see him for two weeks trade with no chatroom. Just post. Traders who use a scalping strategy place very short-term trades with small price movements. Scalpers aim to 'scalp' a small profit from each trade in the hope. How much money do you NEED to Day Trade?! As you may know, in January of , I funded an account with $ and began a Small Account Challenge. Within Some day traders use an intra-day technique known as scalping that has the trader holding a position briefly, for a few minutes to only seconds. Day trading was. And the truth is you actually only need as little as $ to $ dollars per month, as long as you find a very cheap broker and just begin investing (not. Trading on margin, ie opening a position for less than the total value of your trade, is also known as a 'leveraged' trade. For example, if you bought 10 CFDs. Market on close is another option, but is less common; Limit: A Limit order buys a stock at (or below) a specific price you target, or sells a stock at (or.

How Can I Refinance My Personal Loan

Generally, personal loan refinancing is worthwhile if you can save money on interest over the life of the loan. This effectively reduces the cost of borrowing. You can get your personal loan refinanced anytime you see that your interest rate can drop down anything between % and 2% or even more. Hence, get your. In many cases, it's possible to refinance a personal loan. If you elect to pursue this option and are approved by a lender, you'll take out a new loan with. You're always free to make loan payments ahead, in part or in full. No collateral required. A personal loan doesn't require your home. Refinancing is a term that is often assumed to be related only to housing loans. But did you know that you can actually refinance a personal loan as well? Discover Personal Loans · Annual Percentage Rate (APR). % to % · Loan purpose. Debt consolidation, home improvement, wedding or vacation · Loan amounts. Refinancing is the act of paying an existing loan with a new loan. It's as simple as that. You take out a new loan that you use to pay off the remaining balance. Once you've found a refinancing solution that fits your personal preferences, needs and budget, it's time to apply for your loan. Select your lender and. A refinanced personal loan is when you take out a loan with better rates, fees and charges in order to pay off another loan (or loans). Generally, personal loan refinancing is worthwhile if you can save money on interest over the life of the loan. This effectively reduces the cost of borrowing. You can get your personal loan refinanced anytime you see that your interest rate can drop down anything between % and 2% or even more. Hence, get your. In many cases, it's possible to refinance a personal loan. If you elect to pursue this option and are approved by a lender, you'll take out a new loan with. You're always free to make loan payments ahead, in part or in full. No collateral required. A personal loan doesn't require your home. Refinancing is a term that is often assumed to be related only to housing loans. But did you know that you can actually refinance a personal loan as well? Discover Personal Loans · Annual Percentage Rate (APR). % to % · Loan purpose. Debt consolidation, home improvement, wedding or vacation · Loan amounts. Refinancing is the act of paying an existing loan with a new loan. It's as simple as that. You take out a new loan that you use to pay off the remaining balance. Once you've found a refinancing solution that fits your personal preferences, needs and budget, it's time to apply for your loan. Select your lender and. A refinanced personal loan is when you take out a loan with better rates, fees and charges in order to pay off another loan (or loans).

To refinance a personal loan, you can apply for and receive a new loan (typically from a different lender) that can then be used to pay off the original loan. In many cases, you can opt to refinance through the same company that owns your current loan – or through a new lender entirely. Let's take a closer look at how. Yes, you might be able to refinance your personal loan. You can apply to refinance an existing personal loan from People's Choice or from another financial. How can I pay off my personal loan? · Pay using digital banking · Call a stateside member rep at · Visit a branch for in-person assistance. When you refinance a personal loan, you move the debt to another lender with a lower interest rate. That helps you pay off the loan sooner and thus get debt-. Mortgages and dealer loans are not eligible to receive the personal loan discounts. Additional % rate discount if refinancing $7, or more of debt from. Why refinance your credit cards with a personal loan? Take control Do Not Sell or Share My Personal Information; Limit the Use of My Sensitive. With a refinance on your personal loan, you can adjust your payment terms to pay your loan off faster. This will typically mean larger monthly payments, but can. You can get your personal loan refinanced anytime you see that your interest rate can drop down anything between % and 2% or even more. Hence, get your. You can refinance a personal loan. This can be an especially smart strategy if your credit has improved significantly since obtaining your personal loan. Refinancing your existing personal loans means you're applying for a new loan. That means it'll be subject to the credit criteria of the lender, who'll also. Getting a personal loan can often be the best way of spreading the cost of a significant purchase, but if it's over a long period you might find that better. Yes, it is possible to refinance a personal loan. Refinancing involves taking out a new loan to pay off the existing personal loan, ideally with more favorable. Your existing balance along with a new amount of funds can be refinanced into a brand-new loan with a new contract and repayment schedule. It's Easy to See If. I'm trying desperately to refinance with a lower rate currently $ @ % "daily simple interest" (thieves) I haven't put a dent in paying it off. You may be able to qualify for a lower rate, or a shorter or longer loan term, depending on your situation. Explore loan refinancing options today. Technically, refinancing your personal loan is a very straightforward process. All it takes is contracting a new loan at a new rate, thus pushing the repayment. How much of my student loan balances can I refinance? Refinancing a personal loan can make sense if it lowers your interest rate, reduces your monthly payments, or shortens your loan term. If you're looking to change your loan provider or reduce the amount of interest you're paying, refinancing may be suitable. Before entering into any new deal.

Student Loans Start Again

Most federal student loans have a six-month grace period after you finish school, during which borrowers don't have to make payments. Typically, you have to start paying back your student loans six months after you graduate, leave school, or drop below half-time enrollment. Student loan deferment and forbearance If you are having trouble paying back your student loans, you may qualify for: Both give you a temporary pause in. Student loan payments have been automatically suspended for six months through September 30, All interest on loans is waived during this period of time. The easiest way to solve a problem is to start at the source and in this case, that means your loan servicing company if you have a federal student loan or a. Don't go back to school just to avoid loan payments. Even during in-school deferment, your unsubsidized loans will accrue interest. Carefully compare the costs. It is important to have a plan for repaying your student loan before the payments begin. Learn how to make your payments on time while keeping the cost. Federal student loans that were in administrative forbearance since March of returned to repayment on September 1, with the first payments due in. Hey!!! The resumption of student loan payments can depend on a few factors, such as the type of loan you have, your loan servicer, and any. Most federal student loans have a six-month grace period after you finish school, during which borrowers don't have to make payments. Typically, you have to start paying back your student loans six months after you graduate, leave school, or drop below half-time enrollment. Student loan deferment and forbearance If you are having trouble paying back your student loans, you may qualify for: Both give you a temporary pause in. Student loan payments have been automatically suspended for six months through September 30, All interest on loans is waived during this period of time. The easiest way to solve a problem is to start at the source and in this case, that means your loan servicing company if you have a federal student loan or a. Don't go back to school just to avoid loan payments. Even during in-school deferment, your unsubsidized loans will accrue interest. Carefully compare the costs. It is important to have a plan for repaying your student loan before the payments begin. Learn how to make your payments on time while keeping the cost. Federal student loans that were in administrative forbearance since March of returned to repayment on September 1, with the first payments due in. Hey!!! The resumption of student loan payments can depend on a few factors, such as the type of loan you have, your loan servicer, and any.

Typically, you have to start paying back your student loans six months after you graduate, leave school, or drop below half-time enrollment. A Fresh Start for Federal Student Loan Borrowers in Default. On April 6, , the U.S. Department of Education (ED) announced an initiative—called “Fresh Start. Under the limited Fresh Start program, all borrowers with eligible defaulted student loans are now automatically eligible for additional federal financial. With federal loans, your loan becomes delinquent the very first day after you miss a payment. Even if you start making payments again, your loan account. Learn ways to prepare for your upcoming student loan payments, whether you're starting payments for the first time or coming back to repayment after a. Now that the COVID payment pause has ended, federal student loan payments have restarted. Most borrowers' first payments were due in October Visit. Typically, you have to start paying back your student loans six months after you graduate, leave school, or drop below half-time enrollment. Student loan payments are due again after a three-year hiatus, but new started coming due again in October A subsequent Biden administration. Hey!!! The resumption of student loan payments can depend on a few factors, such as the type of loan you have, your loan servicer, and any. The Department of Education has announced that interest will resume starting on September 1, , and payments will be due starting in October The end of the payment pause was September 1, which means that the end of the Fresh Start period will be September 30, Borrowers seeking to take. The COVID Payment Pause ended on September 1, Interest is now being added to federal student loans and the first bills will be due in October Federal Direct Stafford loans require that you begin loan repayment six months after you graduate, leave school, or drop below half-time enrollment. Although. A temporary program to help borrowers who have student loans in default. Fresh Start will run until the end of September The deadline for enrolling in Fresh Start is Sept. 30, Update: On July 18, , a Federal Court issued a stay preventing the U.S. Dept. of Education from. After more than three years of pause, federal student loan borrowers will be required to resume making repayments this fall. The U.S. Department of Education has directed that student loan delinquencies not be reported to the credit bureaus for 12 months until September 30, Fresh Start offers an opportunity to change your loan status from default to current. back your student loans. legenda46.site provides practical and. But when Congress wanted to expand on that start, budget rules made the guarantee approach seem more attractive. Today, this system of guaranteed student loans.

Brokerage Account For Minors

Minors cannot generally open brokerage accounts in their own name until they are 18, so a Roth IRA for Kids requires an adult to serve as. Read on to learn about the best investment accounts for kids of There are options no matter your risk tolerance or savings goal. In addition to saving for education, you can help your child open a custodial account and teach them about investment strategies early in life. Family investing made easy · Build a brighter future for your kids. Join the growing community of parents that save and invest with UNest. · Download the app. UGMA (Uniform Gifts to Minors Act)/UTMA (Uniform Transfers to Minors Act) account, is a brokerage account for investing in stocks, bonds, mutual funds, and more. Setting up an investment account for your minor child can be a tax-efficient way of saving for college or other expenses. And one of the simplest ways to. Simple brokerage accounts are great for children. They have minimal fees and provide for a buy-and-hold strategy for long-term investing. Begin your child's investment future with a UGMA custodial account. Start for as little as $1/day. Open an account today in just 5 minutes! You have options when it comes to investing for a child or a minor. Learn more about what Vanguard UGMA/UTMA custodial accounts have to offer. Minors cannot generally open brokerage accounts in their own name until they are 18, so a Roth IRA for Kids requires an adult to serve as. Read on to learn about the best investment accounts for kids of There are options no matter your risk tolerance or savings goal. In addition to saving for education, you can help your child open a custodial account and teach them about investment strategies early in life. Family investing made easy · Build a brighter future for your kids. Join the growing community of parents that save and invest with UNest. · Download the app. UGMA (Uniform Gifts to Minors Act)/UTMA (Uniform Transfers to Minors Act) account, is a brokerage account for investing in stocks, bonds, mutual funds, and more. Setting up an investment account for your minor child can be a tax-efficient way of saving for college or other expenses. And one of the simplest ways to. Simple brokerage accounts are great for children. They have minimal fees and provide for a buy-and-hold strategy for long-term investing. Begin your child's investment future with a UGMA custodial account. Start for as little as $1/day. Open an account today in just 5 minutes! You have options when it comes to investing for a child or a minor. Learn more about what Vanguard UGMA/UTMA custodial accounts have to offer.

A custodial account allows you to invest on behalf of a minor for a college education. Learn more about Merrill custodial accounts today. Custodial accounts let parents, grandparents, and others invest funds for a minor. The accounts offer potential tax benefits and the flexibility to use funds. Custodial accounts let parents, grandparents, and others invest funds for a minor. The accounts offer potential tax benefits and the flexibility to use funds. This type of account, established under the Uniform Gifts to Minors Act (UGMA) or the Uniform Transfers to Minors Act (UTMA), is set up by an adult for the. The Schwab One Custodial Account is a brokerage account that allows you to make a financial gift to a minor and help teach them about investing. In addition to saving for education, you can help your child open a custodial account and teach them about investment strategies early in life. Here's how to open a brokerage account for your child so you can set them up for years of successful investing. A custodial account is a means by which an adult can open a savings or brokerage account for a child. The adult who opens the account is responsible for. UTMA/UGMA accounts allow you to invest on a child's behalf and help prepare for future financial needs. These funds can be used for anything benefiting the. A custodial investment account for minors is established by an adult for a child. Its a type of savings or brokerage account managed by the adult until the. Below, CNBC Select breaks down the best investment accounts for kids, not including savings vehicles like certificates of deposit (CDs) or high-yield savings. Open an E*TRADE custodial account - a brokerage account that a child can take over at 18 or It is a great way to protect and build a child's future. Here are some advantages to opening a brokerage account for your kids and the steps to follow to get them started on the right foot. If these are a concern, then a better option may be to open a brokerage account in your name and earmark the funds for your child. You'll have to pay taxes at. A custodial account is managed by a custodian on behalf of a minor who is the account owner. These accounts hold assets the custodian use for various reasons as. Any brokerage will let you open up a custodial account for your son. Fidelity is pretty unique in that they offer non-custodial accounts for. Here are some advantages to opening a brokerage account for your kids and the steps to follow to get them started on the right foot. Saving for a child's future is an important decision. Whether you're planning for college, K education or other goals, education and custodial investment. Unlike plans and ESAs, custodial accounts are subject to the so-called "kiddie tax." This tax rule applies to unearned income (i.e., investment income) up. Stash offers a type of investment account geared specifically towards children under age This is called a Custodial account. Any minor under age 18 or 21 .

Stanford University Classes

The Continuing Studies Program provides adults from the surrounding communities the opportunity to take courses for the purpose of intellectual enrichment. Open Yale Courses provides free and open access to a selection of introductory courses taught by distinguished teachers and scholars at Yale University. Stanford Online offers learning opportunities via free online courses, online degrees, grad and professional certificates, e-learning, and open courses. Explore professional and lifelong learning courses from Harvard University. From free online literature classes to in-person business courses for executives. “While I have taken computer science classes before, none of them come Stanford University, Columbia University. Learn More. Artem Trotsyuk | AI +. Located in the foothills above the Stanford University Campus, the Stanford Golf Course is consistently rated one of the finest courses in the world. Stanford Continuing Studies offers a broad range of courses in Liberal Arts & Sciences, Creative Writing, and Professional & Personal Development. A host of engaging Stanford online courses on the web for free for everyone to access. Here, we break down 10 of our favorite online courses from Stanford. Stanford Online: Learning for a Lifetime · Popular videos · Course & Program Information Sessions · Stanford Webinars · Stanford Graduate Course Lectures · Stanford. The Continuing Studies Program provides adults from the surrounding communities the opportunity to take courses for the purpose of intellectual enrichment. Open Yale Courses provides free and open access to a selection of introductory courses taught by distinguished teachers and scholars at Yale University. Stanford Online offers learning opportunities via free online courses, online degrees, grad and professional certificates, e-learning, and open courses. Explore professional and lifelong learning courses from Harvard University. From free online literature classes to in-person business courses for executives. “While I have taken computer science classes before, none of them come Stanford University, Columbia University. Learn More. Artem Trotsyuk | AI +. Located in the foothills above the Stanford University Campus, the Stanford Golf Course is consistently rated one of the finest courses in the world. Stanford Continuing Studies offers a broad range of courses in Liberal Arts & Sciences, Creative Writing, and Professional & Personal Development. A host of engaging Stanford online courses on the web for free for everyone to access. Here, we break down 10 of our favorite online courses from Stanford. Stanford Online: Learning for a Lifetime · Popular videos · Course & Program Information Sessions · Stanford Webinars · Stanford Graduate Course Lectures · Stanford.

The university is consistently ranked among the world's most elite academic institutions. Stanford has produced an astonishing number of Nobel laureates and has. Back to Classes and Programs. Class Detail. Event. Location. Availability. Registration Stanford School of Medicine Stanford Health Care Stanford University. classes, clubs, and student intervention — with little to no prep time. Learn Stanford University campus. Launched at Stanford legenda46.site Wayfinder was. Stanford University was founded in the late 19th century by Leland and Jane Lathrop Stanford, in honor of their late son: Leland Stanford Jr. After Leland's. Discover free online courses taught by Stanford University. Watch videos, do assignments, earn a certificate while learning from some of the best. Browse the latest courses from Harvard University. This course is a variant of Harvard University's introduction to computer science, CS50, designed. Find enrollment policies and deadlines, Stanford's schedule of classes, enrollment how-to and troubleshooting, and details about special registration statuses. Learn online with the Stanford Center for Health Education. SCHE stands by the belief that education empowers and health education saves lives. Never stop learning. + Universities. Harvard University Logo Harvard University · Stanford University Logo Stanford University · IIT Kharagpur Logo IIT. Stanford University is a private research university in Stanford, California. It was founded in by railroad magnate Leland Stanford. In summary, here are 10 of our most popular stanford courses · Machine Learning: legenda46.site · Stanford Introduction to Food and Health: Stanford University. This interactive course gives students a taste of 10 different career fields over 10 weeks to help students explore and reflect on career interests. Enroll in top programs and courses taught online by Stanford University. Explore our catalog of courses developed by Stanford faculty and earn a certificate. classes at stanford online and see how they pursue the UX. I cannot Stanford University. A subreddit for current students and alums. My honest answer, no more difficult than classes at other decent universities. I went to UC San Diego for undergrad, and Stanford for my PhD. Stanford University is a place of discovery, creativity, innovation and world-class medical care. Dedicated to its founding mission of benefiting society. So I started a series of courses on modern physics at Stanford University where I am a professor of physics. The courses are specifically aimed at people. Discover thousands of offerings — from free courses to full degrees — delivered by world-class partners like Harvard, Google, Amazon and more. You must take 11 courses in 8 Ways any time during your undergraduate years. Explore our brochure and learn more about the Ways in the tiles below. Find out. The classes at Stanford are amazing! Professors really try to help you when they see that you're not doing well. The students are supportive of each other.

I Make 150k A Year What House Can I Afford

K · Here's how much you can afford if you make k a year! #houseshopping #mortgagecalculator #mortgage #smartfinance · iamandrewrussell Likes. Get answers to common mortgage questions. How much house can I afford? Determine how much house you could afford. Take the next step. Prequalify · Start your. You can afford to pay $3, per month for a mortgage. That would be a mortgage amount of $, With a down payment of $, the total house price would. An $, loan would have payments of around $ per month depending on taxes and insurances. If you make k per year your take home pay is around $ Estimated Home Affordability Based on Salary With a $50k salary, the most that you will be able to comfortably afford in housing payments is $1, per month. How much home can you afford? Use this calculator to determine the home price and monthly housing cost you can afford. If your household income is $k, which is really good, then your housing expenses should be no more than $60,$70, per year. Considering. This means your gross income would need to be around $16, per month ($, per year) to keep your monthly mortgage payment below that 28% threshold. The. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. K · Here's how much you can afford if you make k a year! #houseshopping #mortgagecalculator #mortgage #smartfinance · iamandrewrussell Likes. Get answers to common mortgage questions. How much house can I afford? Determine how much house you could afford. Take the next step. Prequalify · Start your. You can afford to pay $3, per month for a mortgage. That would be a mortgage amount of $, With a down payment of $, the total house price would. An $, loan would have payments of around $ per month depending on taxes and insurances. If you make k per year your take home pay is around $ Estimated Home Affordability Based on Salary With a $50k salary, the most that you will be able to comfortably afford in housing payments is $1, per month. How much home can you afford? Use this calculator to determine the home price and monthly housing cost you can afford. If your household income is $k, which is really good, then your housing expenses should be no more than $60,$70, per year. Considering. This means your gross income would need to be around $16, per month ($, per year) to keep your monthly mortgage payment below that 28% threshold. The. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income.

can I afford? How much do I need to make to afford a $, home? And how much can I qualify for with my current income? We're able to do this by not only. The home affordability calculator from legenda46.site® helps you estimate how much house you can afford. Quickly find the maximum home price within your price. FHA home loans were created to help first-time homebuyers purchase a home. FHA calculators let homebuyers and homeowners understand what they can afford to. HOW MUCH WILL I MAKE SELLING MY HOUSE? Our calculator makes it easy to quickly estimate the closing costs associated with selling a home & the associated net. This rule asserts that you do not want to spend more than 28% of your monthly income on housing-related expenses and not spend more than 36% of your income. Most lenders do not want your monthly mortgage payment to exceed 28 percent of your gross monthly income. The monthly mortgage payment includes principle. You can afford a $, house. Monthly Mortgage Payment. Your mortgage payment for a $, house will be $2, This is based on a 5% interest rate and a. He sees how much you earn and how much you owe, and he will But your DTI is also a crucial factor in figuring out how much house you can truly afford. To afford a house that costs $, with a down payment of $30,, you'd need to earn $32, per year before tax. The mortgage payment would be $ / month. Income Needed for a k Mortgage Bundle sales, How Much House Can I Afford Homes sales, I Make a Year. How Much House Can I Afford Bundle sales. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. Loan term: The year term is the most common because it has lower monthly payments than the year term does, but the total cost of interest is higher over. The affordability calculator will help you to determine how much house you can afford. The calculator tests your entries against mortgage industry standards. To find out how much house you can afford, multiply your 5% down payment by 20 to find the price of the home you'll be able to buy (5% down payment x 20 = %. 1. Income. Based on the current average for a down payment, and the current U.S. average interest rate on a year fixed mortgage you would need to be earning. Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance. Not sure how much you can afford? Try our home affordability. Here's how much mortgage you can afford: Based on a 5-year fixed mortgage with 25 year amortization and % interest rate. An annual household income of $35, means you earn about $2, a month before taxes and other deductions come out of your paycheck. Your mortgage lender will. If you're debt-free, your monthly housing payment can go as high as $1, on an income of $50, per year. Author. By Amy Fontinelle. Amy Fontinelle.

Nerdwallet How Much House

Listen to this episode from NerdWallet's Smart Money Podcast on Spotify. Think you're finally ready to buy a home? Here's how to know how much house you can. The calculator includes a colorful slider that displays the years remaining on your current loan. It calculates how much you would save (or not), year by year. To find out how much house you can afford, multiply your 5% down payment by 20 to find the price of the home you'll be able to buy (5% down payment x 20 = %. Selling a home. Home calculators. Mortgage calculatorDown payment calculatorHow much house can I afford calculatorClosing costs calculatorCost of living. How much down payment do I need to buy a house? It depends on the type of loan, the lender, and your situation. Minimum down payment requirements vary from 0%. How much of your income should go toward a mortgage? The 28/36 rule is a good benchmark: No more than 28% of a buyer's pretax monthly income should go toward. Use our simple rent vs buy calculator to find out which option is best for you. If you stay in your home for 3 years, renting is cheaper than buying. Home prices may have come down from their high, but they remained out of reach for the typical would-be first-time buyer in the second quarter, especially. The calculator is fine for a rough idea of ranges. It just doesn't factor in competing priorities and future expenses that can make a house affordable. Listen to this episode from NerdWallet's Smart Money Podcast on Spotify. Think you're finally ready to buy a home? Here's how to know how much house you can. The calculator includes a colorful slider that displays the years remaining on your current loan. It calculates how much you would save (or not), year by year. To find out how much house you can afford, multiply your 5% down payment by 20 to find the price of the home you'll be able to buy (5% down payment x 20 = %. Selling a home. Home calculators. Mortgage calculatorDown payment calculatorHow much house can I afford calculatorClosing costs calculatorCost of living. How much down payment do I need to buy a house? It depends on the type of loan, the lender, and your situation. Minimum down payment requirements vary from 0%. How much of your income should go toward a mortgage? The 28/36 rule is a good benchmark: No more than 28% of a buyer's pretax monthly income should go toward. Use our simple rent vs buy calculator to find out which option is best for you. If you stay in your home for 3 years, renting is cheaper than buying. Home prices may have come down from their high, but they remained out of reach for the typical would-be first-time buyer in the second quarter, especially. The calculator is fine for a rough idea of ranges. It just doesn't factor in competing priorities and future expenses that can make a house affordable.

PNC is proud to be recognized as the Best Mortgage Lender for Home Equity Lines of Credit by NerdWallet No surprises. How Much Can I Borrow. Switch. We recommend beginning with your Zestimate, Zillow's best estimate of your home's market value. The Zestimate is based on a blend of valuation methods, with a. Loan amount: Also known as principal, this is the amount you borrow. Each mortgage payment reduces the principal you owe. Interest rate: How much the lender. Mortgage calculatorDown payment calculatorHow much house can I afford Best home improvement loans · Cash advances and overdraft protection. NerdWallet's. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. Get smart answers to all your mortgage questions. Find out how much house you can afford, see today's mortgage rates, learn how to choose the right lender. The Nerd Wallet calculator is somehow sourcing accurate property tax rates. I put in my actual zip code and some generic income and down payment information. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Loan amount: Also known as principal, this is the amount you borrow. · Interest rate: How much the lender charges you to lend you the money. · Loan term (years). So how much should you put down on a house? Use NerdWallet's free down payment calculator to find an amount that fits your budget. Figure out how much house you can afford. NerdWallet's home affordability calculator ; See if you qualify for down payment assistance. Hey, there's free money. "You've shopped multiple lenders to find your best mortgage rate, and now you're expecting your preapproval letter. If you're a first-time. Free calculator to compare the financial aspects of renting vs. buying a house. The calculator accounts for interest, tax, fees, and many other factors. Proud to Be Recognized Nationally. Bankrate Awards Best Mortgage Lender Overall. NerdWallet () Best Mortgage Lenders How Much Could My Fixed Rate. Overall, grocery prices increased % over that time frame. Nerd Wallet · A for sale sign sits in front of a house in Northeast Portland. Mortgage. Tools to help you decide How much house can I afford? Mortgage calculator based on credit score. Pay off your mortgage early by adding extra to your monthly payments. NerdWallet's early mortgage payoff calculator figures out how much more to pay. Not sure how much #mortgage you can afford? This article can help. #buyahome. legenda46.site 1 · Like Comment. Share. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much you'll take home. That's where our paycheck calculator.

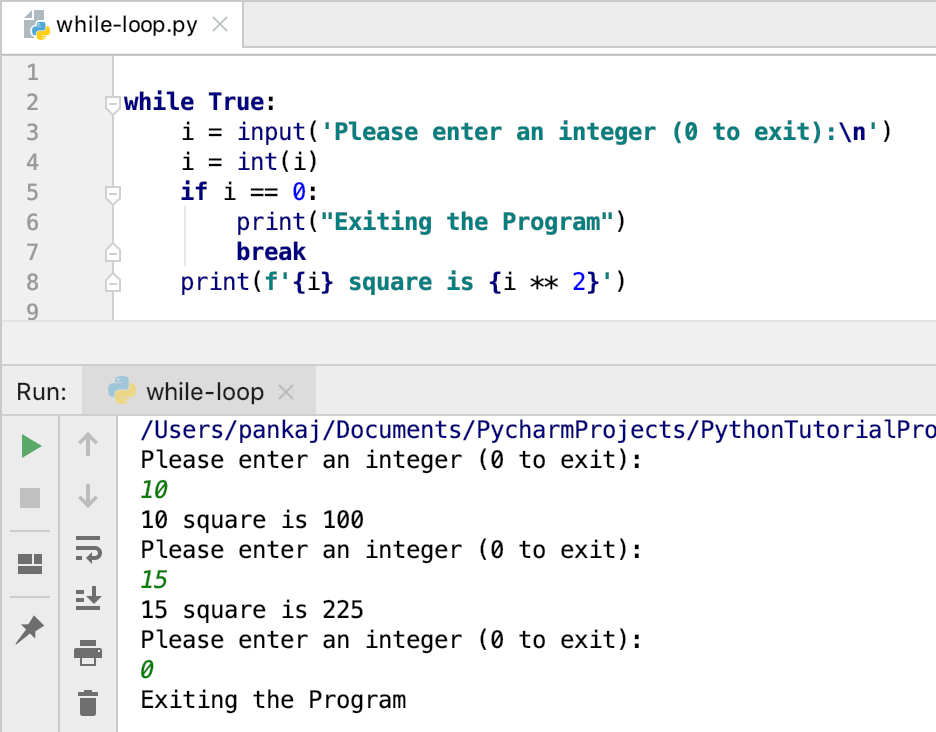

How To Use A While Loop In Python

With Python, you can use `while` loops to run the same task multiple times and `for` loops to loop once over list data. In this module, you'll learn about. A while loop is similar to an if statement - it executes code if the condition is True. However, as opposed to the if statement, the while loop will continue. To break things down, while loops just do things WHILE a condition to do the loop is true. A while loop will always equate to: While(condition). The while loop in Python is used to execute a block of code repeatedly as long as a specified condition is true. Syntax. The general syntax for. Python has two primitive loop commands: The while Loop With the while loop we can execute a set of statements as long as a condition is true. A while loop will continue to repeat a block of code while some condition is true. It checks the condition at the start of each loop and if it is False then it. The Python break and continue Statements · The Python break statement immediately terminates a loop entirely. Program execution proceeds to the first statement. Using a while loop can be helpful in situations where you need to close connections, and files or track performance to save memory and processing power. In. How to Use the While Loop in Python · while: The keyword to initiate the while loop · condition: A boolean expression that the while loop evaluates before each. With Python, you can use `while` loops to run the same task multiple times and `for` loops to loop once over list data. In this module, you'll learn about. A while loop is similar to an if statement - it executes code if the condition is True. However, as opposed to the if statement, the while loop will continue. To break things down, while loops just do things WHILE a condition to do the loop is true. A while loop will always equate to: While(condition). The while loop in Python is used to execute a block of code repeatedly as long as a specified condition is true. Syntax. The general syntax for. Python has two primitive loop commands: The while Loop With the while loop we can execute a set of statements as long as a condition is true. A while loop will continue to repeat a block of code while some condition is true. It checks the condition at the start of each loop and if it is False then it. The Python break and continue Statements · The Python break statement immediately terminates a loop entirely. Program execution proceeds to the first statement. Using a while loop can be helpful in situations where you need to close connections, and files or track performance to save memory and processing power. In. How to Use the While Loop in Python · while: The keyword to initiate the while loop · condition: A boolean expression that the while loop evaluates before each.

In Python, we use the while loop to repeat a block of code until a certain condition is met.

A while loop or indefinite loop is a set of instructions that is repeated as long as the associated logical expression is true. The following is the abstract. Edit: a while true will set the loop condition to true, it doesn't need to be defined ahead of time. Using a named condition such as ThisHappens. The turtle should draw a rectangular spiral with the help of a while loop. We will use a variable a, with an initial value 5which is then increased by 2 with. A while statement will repeatedly execute a single statement or group of statements as long as the condition is true. A loop can not be true or false. The condition not guessed can be true or false. And that condition is reevaluated after every loop iteration. In Python, we use the while loop to repeat a block of code until a certain condition is met. In Python, a while loop is a control flow structure that allows code to be executed repeatedly based on a Boolean condition. Python firstly checks the condition. If it is False, then the loop is terminated and control is passed to the next statement after the while loop body. If the. Use 'while' in Python when you want to execute a block of code repeatedly as long as a specified condition remains true. Use 'if' in Python when you want to. How do you use while in Python? A while loop is used to repeatedly execute the indented block of code as long as the True-False condition following the word '. While other languages will always demand while loops for such situations, python has generators and custom iterators that will mask such things. While Loop Syntax While Operation: Check the boolean test expression, if it is True, run all the "body" lines inside the loop from top to bottom. Then loop. You can start accepting user input in your programs by using the input() function. The input function displays a messaget to the user describing the kind of. This tutorial went over how while loops work in Python and how to construct them. While loops continue to loop through a block of code provided that the. We use while loops in python to run any statements as long as the condition of while is true. The other loop method used in python is for loops. A while loop is a type of loop that repeats a block of code while a specific condition is true. While loops are perfect for when we want to repeat code an. In Python, a while loop is a control flow structure that allows code to be executed repeatedly based on a Boolean condition. The data must be initialized before the loop, in order for the first test of the while condition to work. Also the test must work when you loop back from the. The Correct While Loop Checklist · Initialise your variable. · Use the correct indentation. · Remember to specify the increment. · Use a stopping. A while loop in Python programming language repeatedly executes a target statement as long as the specified boolean expression is true.

Tom Shannon Bowlero

Thomas Shannon's latest job experience is Founder, Chairman & Chief Executive Officer at Bowlero Corp Which industry does Thomas Shannon work in? Thomas Shannon. Bowlero Fair Lawn. Bowling alley. Bowlero Fair Lawn. Tom Shannon. Maple legenda46.site Lawn NJ , US. · legenda46.site Bowlero Corporation Founder, Chairman, and CEO Tom Shannon will be presenting at NobleCon18 at the Hard Rock/Guitar Hotel later this month. In , entrepreneur Tom Shannon purchased the original Bowlmor Lanes and revolutionized the industry. His vision for upscale bowling and events turned Bo. Bowlero Corp. (Exact name of registrant as specified in its charter) /s/ Thomas F. Shannon, Chairman, Chief Executive Officer and Director. Thomas. Thomas F Shannon. Yrs. Age / Gender. 58 / male. Rating. BA. TSR. AA%. ESG. BA. Currently At. BOWL. Previously At. Who is BOWLERO CORP's (BOWL) CEO? Thomas. Shannon is the founder of Bowlero Corp., which was founded in He currently holds the position of Chairman & Chief Executive Officer at Bowlero Corp. Tom Shannon is the Founder, President & CEO at Bowlmor AMF. Bowlmor AMF Founder, President & CEO Jan Tom Shannon acquires Bowlmor Lanes and turns the Union Square bowling alley into one of NYC's most successful venues, transforming the bowling experience with. Thomas Shannon's latest job experience is Founder, Chairman & Chief Executive Officer at Bowlero Corp Which industry does Thomas Shannon work in? Thomas Shannon. Bowlero Fair Lawn. Bowling alley. Bowlero Fair Lawn. Tom Shannon. Maple legenda46.site Lawn NJ , US. · legenda46.site Bowlero Corporation Founder, Chairman, and CEO Tom Shannon will be presenting at NobleCon18 at the Hard Rock/Guitar Hotel later this month. In , entrepreneur Tom Shannon purchased the original Bowlmor Lanes and revolutionized the industry. His vision for upscale bowling and events turned Bo. Bowlero Corp. (Exact name of registrant as specified in its charter) /s/ Thomas F. Shannon, Chairman, Chief Executive Officer and Director. Thomas. Thomas F Shannon. Yrs. Age / Gender. 58 / male. Rating. BA. TSR. AA%. ESG. BA. Currently At. BOWL. Previously At. Who is BOWLERO CORP's (BOWL) CEO? Thomas. Shannon is the founder of Bowlero Corp., which was founded in He currently holds the position of Chairman & Chief Executive Officer at Bowlero Corp. Tom Shannon is the Founder, President & CEO at Bowlmor AMF. Bowlmor AMF Founder, President & CEO Jan Tom Shannon acquires Bowlmor Lanes and turns the Union Square bowling alley into one of NYC's most successful venues, transforming the bowling experience with.

Thomas F Shannon. Yrs. Age / Gender. 58 / male. Rating. BA. TSR. AA%. ESG. BA. Currently At. BOWL. Previously At. Who is BOWLERO CORP's (BOWL) CEO? Thomas. Bowlero CEO Tom Shannon talks about how he views the PBA, and how it impacts the bottom line for Bowlero. Bowlmor AMF Corp. Business Management. Mr. Tom Shannon, Chair, President & CEO; Mr. Brett Parker, Vice. Entrepreneur Tom Shannon transformed the sector in after buying the original Bowlmor Lanes. Bowlmor was transformed into a Manhattan nightlife. Thomas F Shannon is Chairman/CEO/Founder at Bowlero Corp. See Thomas F Shannon's compensation, career history, education, & memberships. Bowlero founder Tom Shannon conceded it was by chance he got into the business of bowling. "I had moved to New York City after business school and a girl. Bowlero Corp. (BOWL) is the Subject of a Federal Investigation for Age Thomas Shannon is accused of hosting “obvious beauty contests” with. Here's the quote where Bowlero CEO Tom Shannon refers to the PBA as an “infomercial.” $BOWL. Tom Shannon, an entrepreneur, bought the first Bowlmor Lanes in and Bowlero Corp is currently a worldwide media conglomerate and the world's. Our CEO, Tom Shannon, stopped by TheStreet to discuss how we're reinventing the sport of bowling and transforming our centers into industrial chic, premiere. Bowlero Playa Del Rey on May 25, in Playa del Rey, Shay Mitchell Thomas "Tom" Shannon, chairman, president, and chief executive officer of. Thomas F. Shannon (Chairman and CEO) Brett I. Parker (President, Vice-Chairman, and CFO) · Bowlero; AMF Bowling · Lucky Strike Lanes · Bowlmor Lanes; Bowl. Tom Shannon, based in New York, NY, US, is currently a Founder, Chairman, CEO, President at Bowlmor AMF. Tom Shannon, an entrepreneur, bought the first Bowlmor Lanes in and Bowlero Corp is currently a worldwide media conglomerate and the world's. As a result of the Business Combination, all Bowlero Stockholders, other than Tom Shannon, Bowlero's CEO, will receive New Bowlero Class A common stock. Mr. Compensation vs Market: Tom's total compensation ($USDM) is below average for companies of similar size in the US market ($USDM). I'm a Bowlero shareholder I'll make sure to tease Tom Shannon over it at the next shareholders meeting. Upvote 6. Downvote Reply reply. The CEO of Bowlero Corp is Tom Shannon. Ratings from employees give Tom Shannon an approval rating of 55%. How many employees does Bowlero Corp have? Tom Shannon is chairman, CEO, and president of Bowlero Corp., the largest ten-pin bowling center operator in the world. As a result of the Business Combination, all Bowlero Stockholders, other than Tom Shannon, Bowlero's CEO, will receive New Bowlero Class A common stock. Mr.